Recent economic indicators paint a picture of a strong economy, even though job growth has recently slowed down a bit. Nevertheless, there are still plenty of job opportunities, and the unemployment rate remains low. Additionally, we’re seeing higher prices for goods and services, which is something to keep an eye on.

All of these factors have significant implications for the commercial real estate sector. The U.S. banking system is holding steady, providing a solid foundation for investment. However, borrowing money has become a bit more challenging for both individuals and businesses, and this could impact economic activity, job creation, and inflation. The extent of these impacts remains uncertain, which is why it’s crucial for those involved in commercial real estate to closely track how the economic landscape is evolving.

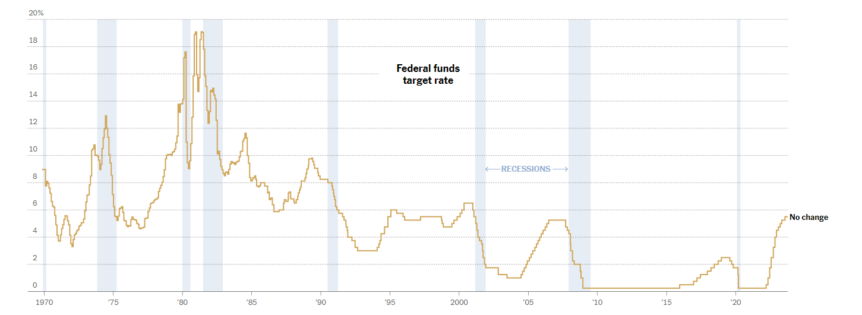

The Federal Reserve, which acts as the bank for banks, has made the decision to maintain interest rates within a specific range (between 5.25% and 5.5%). They’ve chosen this path to ensure that prices remain stable. They are steadfast in their commitment to keeping inflation in check.

For those in the commercial real estate industry, this decision means that borrowing money may be more expensive, potentially affecting investment decisions. Additionally, the Federal Reserve plans to reduce its holdings of certain investments, and this could bring about changes in financial markets that, in turn, might influence how people invest in real estate.

To succeed in this changing economic environment, individuals in the commercial real estate field should closely monitor job markets, inflation trends, and financial dynamics. The possibility of policy adjustments by the Federal Reserve in response to emerging risks underscores the importance of adaptability and a comprehensive understanding of how the broader economy interacts with the real estate market.

In summary, while the Federal Reserve’s choice to maintain higher interest rates presents challenges for the commercial real estate sector, a deep understanding of key economic indicators and a proactive approach to risk management are essential for thriving in this dynamic and evolving economic landscape.